AI Takes the Lead in Transforming India’s FinTech Landscape

India’s FinTech sector is witnessing a major transformation, one being driven not by new regulations or macroeconomic shifts, but by Artificial Intelligence (AI) and Generative AI (GenAI). Once seen as experimental technologies, AI is now at the core of strategic roadmaps across financial services in the country. According to Mordor Intelligence, India’s FinTech market is projected to hit a staggering USD 421.48 billion by 2029, a forecast that underlines the power of AI to unlock exponential growth.

As of 2025, over 90% of Indian financial institutions have named AI as their top innovation priority, a significant shift from even just a few years ago. Whether it’s fraud detection, credit scoring, customer service, or personalized financial products, AI is not just supporting—but driving—key business functions.

Traditionally, AI in finance was treated as a cost-saving measure—automating back-office processes or reducing human error. But the paradigm is changing. AI is now seen as a growth enabler, capable of delivering unique customer experiences and predictive capabilities that were previously unimaginable.

For instance, digital lending platforms are using AI algorithms to assess risk in real-time, even for first-time borrowers who lack formal credit histories. InsurTech companies are deploying GenAI to generate policy documents, simulate risk scenarios, and offer hyper-personalized coverage. Investment platforms are rolling out AI-powered advisors that can automatically rebalance portfolios and optimize tax strategies.

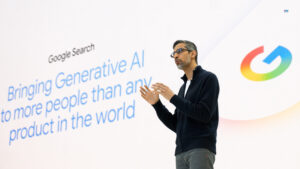

What has captured industry attention is the emergence of Generative AI. By enabling machines to generate human-like content—text, speech, visuals—GenAI is revolutionizing how banks and FinTech startups interact with customers.

Chatbots and virtual assistants powered by GenAI are already answering complex queries in multiple Indian languages, reducing dependency on large customer support teams. Some startups are also exploring GenAI-generated financial literacy content tailored to local contexts, bringing new-to-tech users into the fold with ease.

Several factors are converging to accelerate AI adoption:

- Availability of structured and unstructured financial data from India’s booming digital economy.

- Regulatory encouragement for innovation sandboxes and digital KYC frameworks.

- The falling cost of computing and cloud infrastructure, making experimentation cheaper.

- Global investor interest in AI-first FinTech startups, increasing with risk appetite.

These drivers are encouraging both incumbents and disruptors to invest heavily in AI R&D and product integration.

While the promise is enormous, experts warn against over-reliance on AI without proper guardrails. Issues such as algorithmic bias, data privacy, and explainability are growing concerns, especially in high-stakes sectors like lending and insurance.

However, if balanced well, the opportunities outweigh the risks. The FinTech sector, with its agility and tech-first mindset, is uniquely positioned to set global benchmarks in ethical, scalable AI deployment.

India’s FinTech sector isn’t just embracing AI—it’s being reshaped by it. As companies increasingly move from pilots to production-scale deployments, AI is transitioning from a technological novelty to a strategic imperative. The next five years could define whether India becomes not just a leader in FinTech, but a pioneer in AI-powered finance for the world.