Meta to Acquire 49% Stake in Scale AI for Nearly $15 Billion to Supercharge Generative AI Push

Meta Platforms is preparing its largest external investment ever, committing approximately $14.8 billion to acquire a 49% stake in data-labeling specialist Scale AI, in what Reuters reports as a strategic move to accelerate its generative AI ambitions .

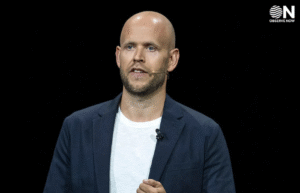

The proposed investment, though not yet finalised, would channel substantial capital into Scale AI’s existing shareholders—among them Accel, Index Ventures, Founders Fund, and Greenoaks, and benefit current and former staff. As part of the deal, Scale AI’s CEO, Alexandr Wang, will take a senior leadership role at Meta, helming a new “superintelligence” lab focused on next‑generation AI efforts.

Scale AI, founded in 2016, supplies labelled training data crucial for machine learning models—from autonomous navigation to chatbots. The company generated about $870 million in revenue in 2024, with estimates expecting it to exceed $2 billion this year. Its valuation, previously set at $13.8 billion, may rise further amid anticipated over $2 billion in revenues and a potential $25 billion tender offer to shareholders.

For Meta, the investment signals an urgent bid to catch up in the fast‑evolving generative AI race. Despite launching its Llama 4 model in April, Meta’s AI performance lagged expectations, and its much-hyped “Behemoth” model faced delays. Now, the Scale AI partnership aims to embed cutting-edge data pipelines and AI expertise directly into Meta’s operations—enabling deeper capabilities in model training and alignment.

The structure of this minority-stake acquisition is reportedly being designed to minimize antitrust scrutiny, mirroring past concerns around Meta’s other major acquisitions, including WhatsApp and Instagram. Since Meta isn’t fully acquiring Scale, it avoids many regulatory pitfalls while securing access to its core capabilities.

This move also fits a wider trend: big tech players engaging in multibillion-dollar minority investments in specialised AI firms. Alphabet, Amazon, and Microsoft have made similar high-profile deals—such as Anthropic and OpenAI—highlighting the industry’s urgency to secure AI expertise and infrastructure amid competition.

Bringing Scale AI’s 28‑year‑old CEO Alexandr Wang to lead its superintelligence initiative indicates Meta’s desire to bolster internal vision and talent. Wang, who co-founded Scale in 2016 and has since scaled it through its public-sector and commercial footholds including a Department of Defense contract—will play a central role in Meta’s AI roadmap.

This deal would represent Meta’s single-largest external investment, following a $15 billion-plus capital expenditure plan for AI infrastructure in 2025 including GPU buildup and cloud capacities . It signals Meta’s shift from internal R&D towards strategic global partnerships to enhance its generative AI edge.

Competitors are reacting in kind: Microsoft already holds a significant stake in OpenAI; Amazon and Google have backed Anthropic; and Meta sees Scale AI as the essential data-labelling backbone it previously lacked.

Meta’s near‑$15 billion investment in Scale AI is a bold strategic bid to reset its generative AI roadmap. By securing data infrastructure and superintelligence leadership, Walmart aims to rejuvenate product development and better compete in the race to build powerful, foundational AI models.