Tax Planning 2.0: How the 2025 Regime Impacts Your Financial Strategy

The Union Budget 2025 has brought significant changes in taxes that will affect individuals and companies equally. The government is looking to reduce tax payments and to reduce the burden by changing the tax payments and adding new rules for investment taxes. A major aspect, INR 12,00,000 tax slab is the beginning, which offered relief to the majority of taxpayers.

Also, reworked tax rules will redefine individual personal financial planning. Adjustments in TCS charges on foreign travels, education loan, and other remittances will make operations easier. Shifts in take-home pay rules and rent rules will also make an impact on how individuals budget their money. This guide gives an in-depth analysis of the most significant budget updates and their impact on taxpayers. Knowing these updates will enable people and firms to plan more effectively and make smart financial decisions. By being up-to-date, taxpayers can transition nicely into the new policies and achieve the most financial benefits.

New Tax Brackets and Their Impact

One of the major announcements is the addition of a new slab of tax with a ceiling of INR 12,00,000, giving relief to middle-class earners. This change, coupled with revisions in tax laws, is likely to bring about relief from the financial burden for the taxpayers. Also, revisions in take-home pay structures and rent income rules will impact personal financial planning.

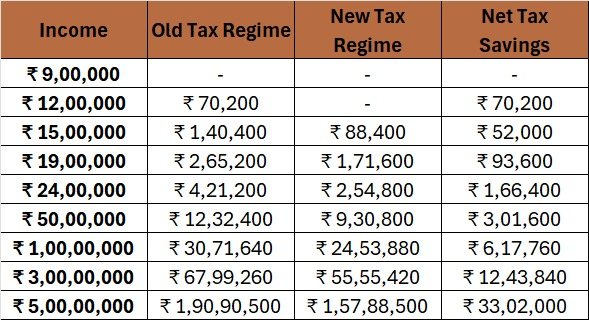

New Tax Regime vs. Old Tax Regime for FY 2025-26

A comparison of the New and Old Tax Regimes identifies the savings that accrue from changed tax slabs. The new system benefits taxpayers with incomes between INR 9,00,000 and INR 5,00,00,000, where tax burdens are reduced significantly.

The tax savings are determined by calculating the difference in taxes payable for FY 2025-26. A total deduction of ₹4,25,000 is factored in, covering Section 80C (₹1,50,000), medical insurance under Section 80D (₹25,000), NPS contributions under Section 80CCD(1B) (₹50,000), and home loan interest under Section 24 (₹2,00,000).

Surcharges and cess remain in tax calculation, with a 10% surcharge on income exceeding INR 50 lakh, 15% on income exceeding INR 1 crore, and 25% on income exceeding INR 5 crore. In addition, there is a Health and Education Cess of 4%.

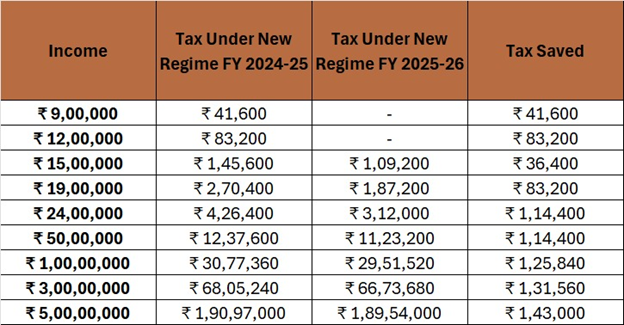

Comparison of FY 2024-25 tax rules with FY 2025-26 tax rules

The new tax regulations provide a lot of relief, particularly to those earning INR 12 lakhs and below, since they will not have to pay any taxes. Also, as income levels increase, tax savings also rise, ranging from INR 36,400 to INR 1,43,000.

The incomes mentioned are post-deduction of the standard deduction—₹50,000 for FY 2024-25 and ₹75,000 for FY 2025-26. Education Cess and Surcharge have been factored into the tax amount wherever applicable.

Major Shifts in ULIP Investments

As of April 2026, ULIPs with annual premiums exceeding ₹2.5 lakh will now be subject to capital gains tax upon redemption, aligning them with the taxation of equity mutual funds. If you invest more than INR 2.5 lakh premium annually on Unit-Linked Insurance Plans (ULIPs), you will have to pay a 12.5% tax on long-term (holding exceeding 1 year) capital gains, while on short-term (holding of less than 1 year) capital gains, you will have to pay a 20% tax.

High-premium ULIPs have become less tax-friendly, whereas policies with annual premiums under ₹2.5 lakh continue to enjoy tax exemption under Section 10(10D).

Major Changes & Impact on AIFs

Alternative Investment Funds (AIFs) will benefit from a reduced capital gains tax of 12.5% for selling securities, thereby lessening tax burdens. Further, the elimination of the Tax Collected at Source (TCS) provision on securities transactions eases compliance and improves the attractiveness of AIFs for long-term investors.

Increased TCS Threshold Limit & Relief for Education Loan

The budget has increased the Liberalized Remittance Scheme (LRS) TCS threshold limit from INR 7 lakh to INR 10 lakh, reducing tax liability on regular foreign transactions. The remittances for education loans from authorized institutions are now fully exempt from TCS, easing the facilitation of overseas education arrangements by students.

Tax Relief on Two Self-Occupied Properties

Homeowners will now be eligible to claim tax relief on two self-occupied houses, a significant change from the earlier policy of allowing only one. From April 2025, tax on notional rent on the second house will be exempt. The TDS limit on rental income has also been increased from INR 2.4 lakh to INR 6 lakh annually, which will ease compliance for both tenants & landlords.

Benefits for Debt Mutual Fund Investors

Capital gains from debt MFs now qualify for rebates under the new tax regime.

Debt MFs bought after April 2023 benefit from a tax rebate of up to ₹60,000 under the new regime. This significantly lowers the tax burden.

Debt MFs bought before April 2023 do not qualify for rebates, but the standard deduction has been increased by ₹1 lakh, reducing taxable gains.

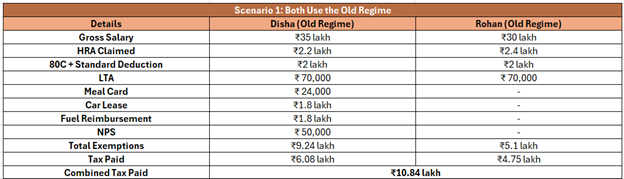

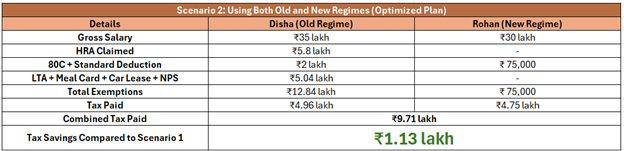

How Couples Can Maximize Taxes Under Old & New Regimes

With the shifts in tax slabs, couples can strategically maximize their tax burden. While one spouse takes all deductions & HRA under the old regime, and the other takes the new regime to get maximum savings. For example, a couple pay INR 60,000 in rent earlier claiming equally under the old regime, can save taxes upto INR 1,13,000 by one choosing the new regime and the other choosing the old regime to reap the maximum tax benefits.

Other Miscellaneous Adjustments

NPS Vatsalya: Taxpayers also receive a new INR 50,000 deduction under Section 80CCD(1B). 60% of withdrawal will be tax-free, while 40% need to be utilized to purchase annuities.

NSS Withdrawals: NSS withdrawals (both principal & interest), effective from August 2024, will be exempt from taxation, providing more ease for investors.

Updated ITR Filing: The deadline for filing updated Income Tax Returns (ITRs) has been extended to 4 years from the relevant assessment year, an increase from the prior 2-year window.

The tax regime of 2025 presents taxpayers with many taxpayer-friendly choices without compromising on the efficiency and streamlining of the tax regime. From increased levels of exemption to overhauled taxation of capital gains, all these developments present numerous avenues for maximizing the tax burden. Taxpayers and enterprises alike need to revise their financial strategies to take advantage of these new benefits.

Author: Ajay Kumar Yadav CEO and CIO, Wise Finserv

Disclaimer: The views expressed in this article are solely those of the author and do not necessarily reflect the opinions or policies of ObserveNow Media. The author is solely responsible for ensuring the accuracy, completeness, and validity of the information presented, encouraging readers to independently verify and seek professional advice if needed.