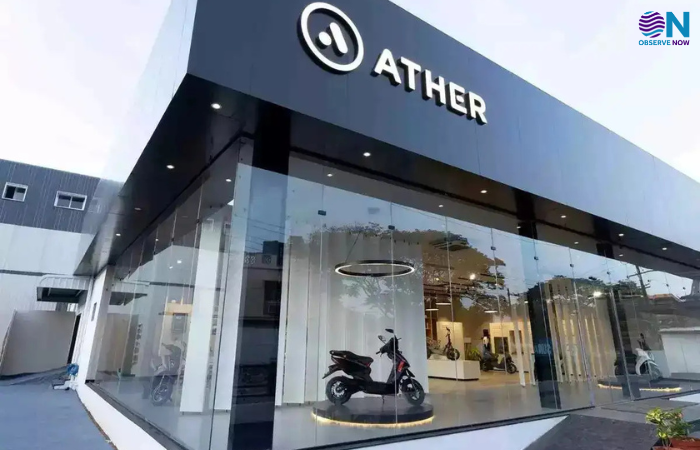

Ather Energy’s IPO: Big Boost for Employees as ESOPs Expected to Unlock ₹530 Cr

Bengaluru-based electric scooter manufacturer Ather Energy is set to launch its initial public offering (IPO) on April 28, 2025, aiming to raise ₹2,981 crore. A notable aspect of this IPO is the potential wealth creation of approximately ₹530 crore for over 1,300 employees through the company’s Employee Stock Option Plan (ESOP).

According to Ather’s red herring prospectus, the company has allocated around 16.5 million shares under its ESOP scheme. At the upper end of the IPO price band, set between ₹304 and ₹321 per share, the total value of these ESOPs could reach ₹530 crore. Employees will have a one-year lock-in period post-listing before they can liquidate their shares.

The IPO comprises a fresh issue of ₹2,626 crore and an offer for sale (OFS) of ₹354.76 crore. Prominent investors such as Tiger Global and GIC are expected to realize significant returns, with Tiger Global poised for an 8.3x return on its investment. Hero MotoCorp, holding a 40% stake in Ather, will not participate in the OFS.

Ather plans to utilize the proceeds from the IPO to expand its manufacturing facilities, invest in research and development, repay debts, and enhance its retail network. The company’s flagship products, the Ather 450 and the recently launched Rizta, have contributed to a 28% increase in revenue to ₹1,578.9 crore in the first nine months of FY25, while losses narrowed to ₹577.9 crore

The IPO is scheduled to close on April 30, with the listing anticipated on May 6, 2025.