PayU Invests $5 Million in Mumbai’s BriskPe, Spearheading Cross-Border Payments Expansion

PayU has injected $5 million into BriskPe, a Mumbai-based cross-border payments platform, marking the startup’s inaugural institutional funding round. PayU aims to fortify its position as a comprehensive payments solution provider, spanning both domestic and international transactions. This investment aligns with PayU’s broader strategy to enhance its offerings for both exports and imports within India.

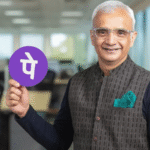

BriskPe, which emerged from PayU’s inaugural accelerator program, Infinity, is led by industry veterans including Sanjay Tripathy, former HDFC Life chief marketing officer, Nilesh Pathak, previously the CTO at Nium, a cross-border payments platform, and Indunath Chaudhary, with experience from Citibank and ICICI Bank.

Read more: HDFC Bank Greenlights Rs 60,000 Crore Fund Raise Through Debt Instruments

Prosus, the parent company of PayU, intends to further fuel the growth of cross-border payments, leveraging new regulatory frameworks such as PA-Cross Border. BriskPe now enters into competition with established players like Skydo, PayPal, and Razorpay in the cross-border payments landscape.

The startup specializes in providing payment processing solutions tailored for small exporters and freelancers catering to global clientele. While previously regulated under the Online Payment Gateway Service Provider guidelines, BriskPe will now seek licensing under the PA-CB regulations of the RBI.