Debopam Chaudhuri Explores Economic Outlook for BFSI Sector Considering Global Monetary Policies: Exclusive Interview with ObserveNow

New Delhi: As we approach the unveiling of the 2024 budget, anticipation looms regarding the fiscal measures and policies that might shape the economic landscape. The financial sector, particularly Banking, Financial Services, and Insurance (BFSI), stands at the forefront of potential changes. Stakeholders eagerly await insights into regulatory adjustments, tax reforms, and strategic initiatives that could impact their operations

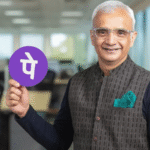

Against the backdrop of evolving domestic and global economic conditions, the upcoming budget is poised to set the tone for the BFSI sector’s outlook in the year ahead, navigating challenges and leveraging opportunities in a dynamic financial environment. In this regard Mansi Gupta, ObserveNow interacted with Debopam Chaudhuri, Chief Economist, Piramal Enterprises Limited.

Here are a few excerpts from the interview:

As we anticipate the upcoming 2024 budget, could you share your expectations and predictions regarding the fiscal measures or policies that may be introduced, and how you foresee these potential changes impacting the BFSI Sector?

India has largely been a capital deficit nation. Our financial system is overly dependent on commercial banks, especially public sector banks, even after 75 years of independence. Hence it is important to undertake fiscal policies that are aimed at easing the supply of capital by further diversifying its supply. Reforms should aim at increased participation from other stakeholders including insurance companies, mutual funds, pension funds and NBFCs. The next 25 years will witness a sharp rise in demand for credit augmented by rapid technological strides being made through India Stack. Hence a large number of capital and credit providers need to be activated to meet this demand.

Can you provide an overview of the current economic landscape in the industry Piramal Enterprises operates in and any notable trends?

As Indian economy expands to become the third largest GDP in the world over the next few years, there will be a sharp rise in demand for credit, both institutional and retail. Rising affluence, evolving preferences and growing disposable income will lead to a very large domestic market attracting large private capex to meet this demand. Additionally, India’s ambition to be a part of global supply chains will lead to a fast-paced demand for expansion across manufacturing, leading to higher credit demand. It is evident that NBFCs will play an important role in meeting this demand from institutions and retail consumers.

How do you assess the economic outlook for the sector in the upcoming year, considering both domestic and global factors?

Tight monetary policies across the globe to address a synchronous spike in retail inflation has resulted in a sharp escalation in costs for this sector. However, due to high credit demand in India, credit growth did not undergo any slowdown owing to high borrowing costs. Additionally, better regulatory coverage helped this sector to strengthen its book with reduced NPAs and higher capital adequacy ratios (higher than regulatory requirements). As India continues to remain the fastest-growing major economy, the corresponding demand for credit will bode well for the sector.

Conclusion:

The BFSI sector, particularly in India, is poised for potential changes driven by fiscal measures. The focus on diversifying the supply of capital, involving stakeholders like insurance companies and NBFCs, reflects a strategic approach to address the country’s historical capital deficit. The anticipated rise in credit demand, fueled by technological advancements and India’s economic expansion, positions NBFCs to play a crucial role. Despite global challenges like tight monetary policies, the sector seems resilient, benefitting from a robust regulatory framework and the sustained demand for credit in India’s fast-growing economy. Overall, the upcoming budget is expected to set the tone for a dynamic year ahead in the BFSI sector, navigating challenges and capitalizing on opportunities.